Skynet RC – Intelligent Process Automation (IPA) vs. Business Process Automation (BPA)

The year was 2008, the same year Bill Gates stepped down as the CEO of Microsoft. I found myself in a situation that was best described as a scene from The Wolf of Wall Street. I sat in a glass meeting room located on the 30th floor of Bank Street in Canary Wharf where I was being interviewed by a couple of “suits”. During the interview, I was questioned “so ... how good are you with WinRunner?” I responded with the default contractor answer of “well it depends, what you are trying to do?”. The next question shocked me, “do you see all the people on this floor?” I nodded, “well ... we are about to let them all go… and we need automation” someone then walked up onto a stage and announced that everyone on the trading floor had been let go.

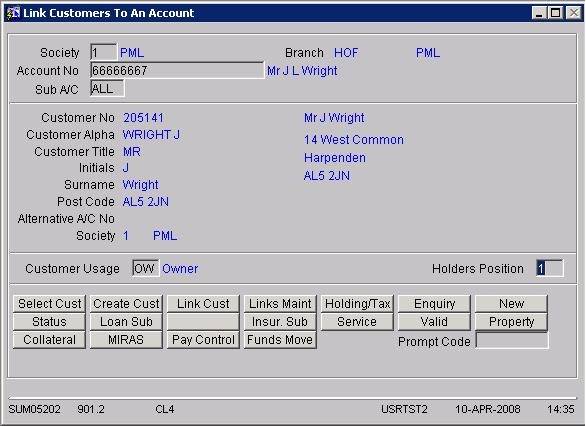

As people started to leave, they continued to explain that they had bought millions of mortgages and loans from various organisations/providers and needed them to all be boarded/migrated onto their target platform (see above) so they could be serviced.

Six months later, my time at Lehman Brothers had taught me a valuable lesson on the importance of Business Process Automation (BPA) and the potential value of enterprise RPA to an organisation. This could be driven by Operational Efficiency, Speed to Market or even traditional ROI / cost saving:

- Operational Efficiency - What do you think the percentage is of Human error when you have 100+ mortgage agents boarding loans 24/7 and what is the impact of missing a zero or keying in the wrong number?

- Speed to Market - How long does it take from purchasing subprime to be able to underwrite/service the loan? (i.e. when they could start making money)

- ROI / cost saving - Reducing headcount by 100+ mortgage agents (or redeploy them to better use as SMEs) and replacement with robotic agents (WinRunner VMs).

One of the major challenges around replacing humans with robots is that they lack the context-sensitive validation that human SME has many years of experience in each industry, both vertical or domain. For example, what happens when one of the mortgage platforms categorizes the property as a studio apartment and the other system categories it as a one-bedroom flat?

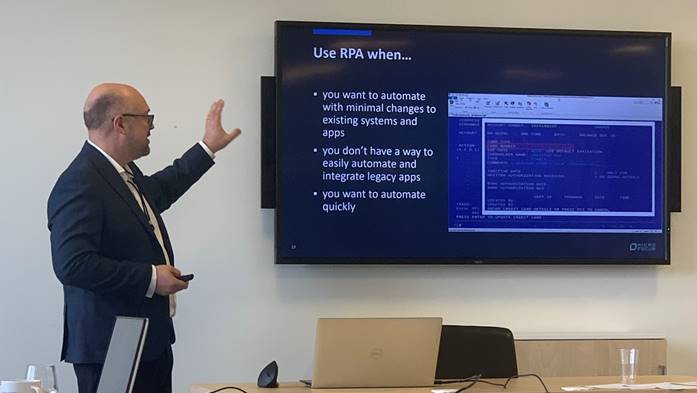

This is where Intelligent Process Automation (IPA) comes in by factoring in the decision making based on a domain / context specific model of the solution (i.e. modelling derivatives and providing the associated data sets). This topic was explored at the RPA Tech Day in London on Wednesday 26th September (see above photo).

Additionally that week, I had finished recording a podcast with Joe Colantonio which explored this subject in much more detail around ‘Shift Right’ and learning how to model the behaviour of systems from production. In turn, this highlights a challenge with modelling. What happens when a journey is not discovered (an edge case) or a decision tree is not executed by the system? This is another challenge with process mining or node discovery (discovering every possible path through a system).

Forget adding additional Chaos Engineering approaches of ‘what if’ scenarios to handle systemic failure. But, are we saying that RPA is destined for failure (similar that of early digital transformation efforts) because the systems that humans have built are too complex or are we saying that the lessons that we have learned from the past can help us avoid making similar mistakes when it comes to Enterprise RPA adoption?

The RPA Tech Day at the Micro Focus office in London which was very similar to the workshop that I attended in South Africa last month. The messaging had again evolved taking another step toward differentiating Micro Focus within the RPA industry. The key differentiator being Business Process Automation (BPA) capabilities and augmenting intelligence through SME and the autonomy of the dissecting the process targeted for RPA.

I’d swap activities and interactions around as an activity can be made up of several interactions with potentially different systems (i.e. context switching). Another observation was the importance of Digital Experiences (DX) over User Experiences (UX) I.e. focusing on what the human does instead of the cause and effect modelling of what upstream and downstream activities are being triggered (check out my chapter in the Digital Quality Handbook for further detail).

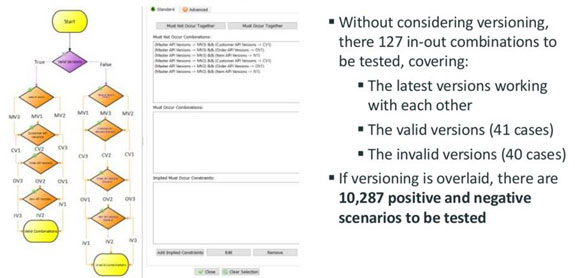

Another challenge is how many possible flows through the above process, is it 5, 10, 25, 100, infinite? At the time of publication, the simple process flow above (taken from the Experiences in Test Automation by Dorothy Graham) I had estimated 25 flows, unfortunately, I was completely wrong. I remember running a workshop in California on code coverage techniques on LCSAJ (Linear Code Sequence & Jump) with only a single loop, to cover all paths with all data permutations results in the nearly infinite possible path.

I recall when I was based in Silicon Valley as the product owner for the market-leading model-based testing (MBT) tool, we used various techniques and graph theory to optimize the best coverage possible. It was only when dealing with companies like Apple & PayPal when we realised that modelling the data of the flows was as important, if not more important that all paths through the system.

Let us take PayPal as a simple example. My PayPal balance is £100 and I’m in Dubai and I want to pay for my Uber which is 450 Dirham which is fine based on the current financial exchange (FX) rate of 0.22 but it is the end of the month and suddenly Brexit happens and the FX rate suddenly changes at the end of the day and I’m left with a negative balance (which is not possible on my account). This is known as an edge case that may have not happened before in production or have been negatively tested. So, who is to blame? The customer, they had enough money at the time when the transaction occurred but after the FX spike, they didn’t? PayPal, who should be able to make real-time payments and not overnight batch things up? Uber, for sending a debt collection letter as they were not able to collect the fee to pay the third party driver?

You may be asking what has this got to do with Robotic Process Automation (RPA)? The short answer is everything. Replacing a human with a machine may catch 85% of the Business Process Automation (BPA) flows, but who is left to pick up the other 15% which fails? Augmenting Intelligence with skills SMEs and providing RPA as a Service (RPAaaS) seems like the only logical way of successfully navigating the challenges of Business Process Automation (BPA) to establish Intelligent Process Automation (IPA).